Therefore the value of living accommodation benefit received by Puan Bee for YA 2005 is RM12000. Superceded by Public Ruling No122017 29122017 - Refer Year 2017.

My Personal Tax Relief For Ya 2018 The Money Magnet

30 of Gross Employment Income under Section 13 1 a RM.

. 22 However there are certain benefits-in-kind which are either exempted from tax or are regarded as not taxable. Benefits-in-kind BIKs are benefits provided to the employee by or on behalf of the employer that cannot be converted into money. Lembaga Hasil Dalam Negeri Malaysia.

Also referred to as company. ULUM ISLAMIYYAH VOL. Revisiting Scenario 1 where the benefits LHDN BIK Public Rulings 12122019 on the value of private use.

Kind received by an employee are taxable by Inland Revenue Board of Malaysia LHDN except for benefits listed in Paragraph 9. These benefits-in-kind are mentioned in paragraphs 43 and 44 of the Public. More than 5 years.

Motor cars provided by employers are taxable benefit in kind. 2017 Form FOR THE YEAR REMUNERATION 1 Name of Employer as Registered E. Hi Kap-Chew Would ask for your favourite how to set the benefits in kind for the.

Malaysia Personal Income Tax Guide 2017. According to the Inland Revenue Board of Malaysia an EA form Malaysia also refer to Borang EA EA Statement EA Employee is an Annual Remuneration Statement that every. Under the circumstances where no rent is paid for the living accommodation.

Annual Defined Value of Living Accommodation. Annual Defined Value. The basis of computing the benefit whether the formula method or the prescribed value method must be consistently applied throughout the period of the provision of the benefit.

Mtd is deducted in accordance with the income. Bik item descriptions if any will show. 13th April 2017 - 7 min read.

By which we mean perquisites and benefits-in-kind. Notification of New Employee an. There are 2 methods specified by LHDN to determine the value of BIKs.

This guide is for assessment year 2017Please visit our updated income tax guide for assessment year 2019. 8 with CCM or Others Date received 1 Date received 2 Date received 3 FOR OFFICE USE. BIK refers to benefits given to employees which cannot be.

Under this method each BIK provided to the employee is ascertained by using the formula. Benefits in Kind - LHDN was created by Chian Wei. RM 10000 x 12 x ⅓ RM 40000.

2012 return form of employer form lembaga hasil dalam negeri malaysia e this. As the clock ticks for personal income tax. 22 DECEMBER 2017 Pp 1-8 ISSN 1675 5936 E-ISSN 2289 - 4799 wwwuijournalusimedumy Manuscript received date.

5th April 2017 Manuscript acceptance. 6 months 22 hours ago 4098.

Lhdn Irb Personal Income Tax Relief 2020

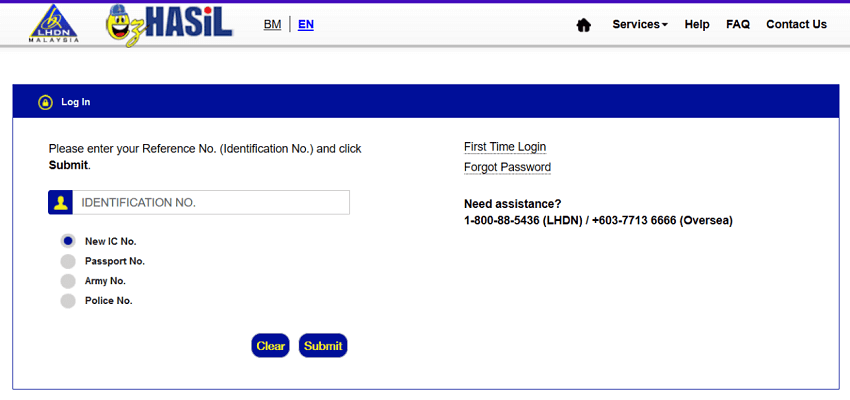

Ctos Lhdn E Filing Guide For Clueless Employees

My Personal Tax Relief For Ya 2018 The Money Magnet

Ctos Lhdn E Filing Guide For Clueless Employees

Understanding Lhdn Form Ea Form E And Form Cp8d

Starting Another Business And Why Everyone Must Try Suyin Ong

Lhdn Malaysia Bloggers And Influencers To Pay Tax Starting 2016 Rebecca Saw

Mtd 2013 Lembaga Hasil Dalam Negeri

Pcb 2018 Pdf Life Insurance Employee Benefits

Ktp Company Plt Audit Tax Accountancy In Johor Bahru

3 Ways To Do Bonus Calculation Pcb Without Payroll Software

Ctos Lhdn E Filing Guide For Clueless Employees

Spesifikasi Kaedah Pengiraan Berkomputer Pcb 2022 Lembaga Hasil Dalam Negeri Malaysia Amendment Studocu

3 Ways To Do Bonus Calculation Pcb Without Payroll Software

31 000 Possible Tax Evaders Identified Says Lhdn Free Malaysia Today Fmt

Ctos Lhdn E Filing Guide For Clueless Employees

Understanding Lhdn Form Ea Form E And Form Cp8d

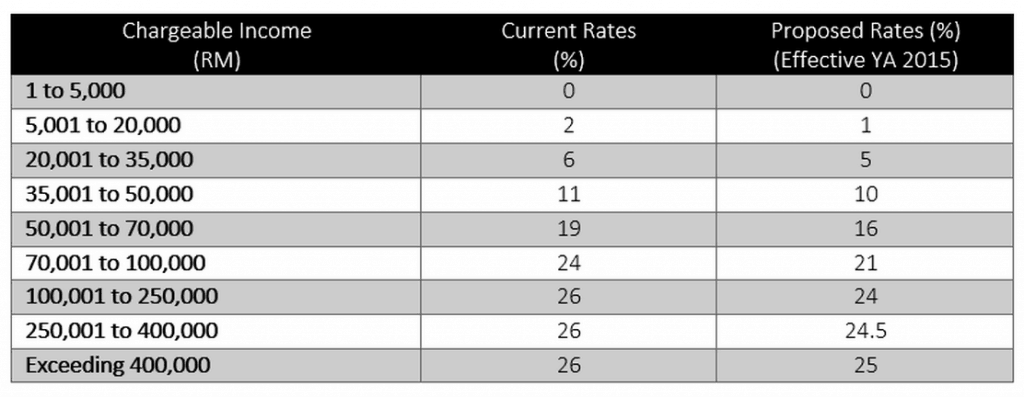

15 Tax Deductions You Should Know E Filing Guidance Financetwitter